Private Clients

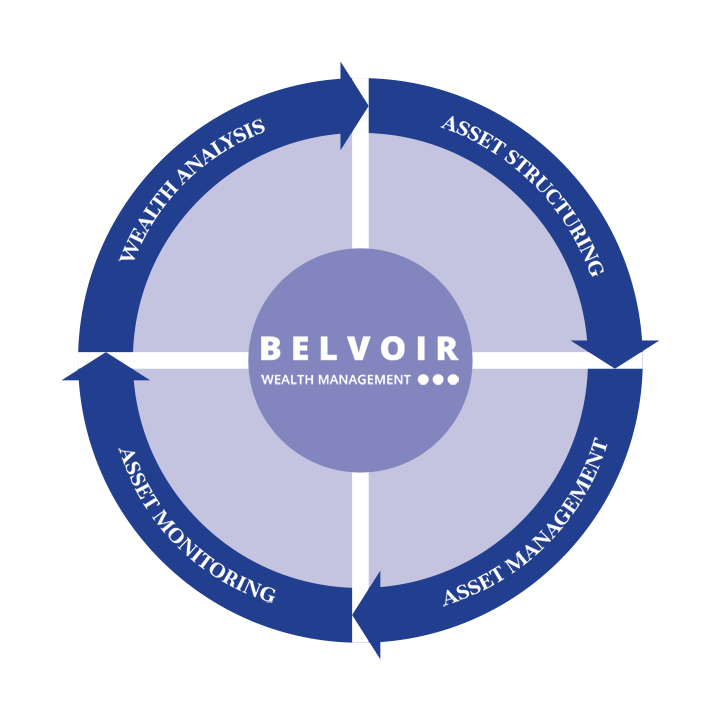

A detailed analysis serves as the basis for the correct structuring of your assets. We want to understand your needs and expectations, your risk tolerance and your risk capacity. Active questioning enables us to determine the right target coordinates for your investment.

Together we develop the optimal investment principles for you. At this stage, we clarify which asset classes are suitable for your investment. Should asset classes be excluded or limited in amount? The selection of the right custodian and, at the end, the tailor-made asset management agreement round off the asset structuring process.

The implementation of your asset management mandate is carried out by our experienced portfolio managers. In principle, we manage our clients’ mandates using a multi-asset approach.The Sloan Investment Committee’s analysis results for the asset classes and the various investment instruments are incorporated directly into your portfolio composition from a conscientious and long-term perspective. We regularly assess the economic and political conditions that influence the development of your assets and make adjustments independently in your interest. Risk management and opportunity management complement each other.

We monitor your investments via our in-house system in a target/actual comparison. Does the development correspond to the target coordinates? Were the return opportunities consistently exploited? We regularly compare these and other questions. You will receive a detailed report on the development of your assets at least quarterly and your client advisor will always be available for a personal meeting.

Family Office

Belvoir Wealth Management AGis a multi-family office.

We are happy to share our wealth of experience in providing holistic advice and support to families and clients.

In a personal conversation you will experience how you can benefit from our knowledge.